6. Bank Card Payment¶

6.1. Objectives¶

Provide types and interfaces for payment terminals

6.1.1. Supported use cases¶

6.1.1.1. Normal flow¶

Payment made with credit card.

Normal (few hours) charging session happens.

Once session is finished, the payment terminal commits bank transaction

Backend communication module receives the information about the bank transaction and sends it to the backend

6.1.1.2. Interrupted charging¶

Note

This is not yet represented in the interfaces.

Customer pays with the card

The charging never starts

After timeout, bank transaction is cancelled (maybe it should be communicated to the backend as well?)

6.1.1.3. Too expensive session¶

Depending on the bank/terminal, there could be a limit on maximum transaction amount. (E.g. if the flow is: reserve some amount, once transaction finished, do a partial return).

Customer pays with a card

Customer charges a lot of electricity over some reasonably long time

Once current session costs are at the limit, session is stopped

Transaction is committed to bank

This has no representation on the interface level. It should be implemented as a module. Module subscribes to the session cost, and once it reaches the limit, it tells the EvseManager to stop the session. The session is finished and committed as usual after that.

6.1.1.4. Too long session¶

Depending on the bank, the reservation shouldn’t be held for more than a few days. And similar to the previous case, the session should be interrupted if transaction time is at the maximum limit.

6.1.2. Solution¶

6.1.2.1. Introduce new interfaces¶

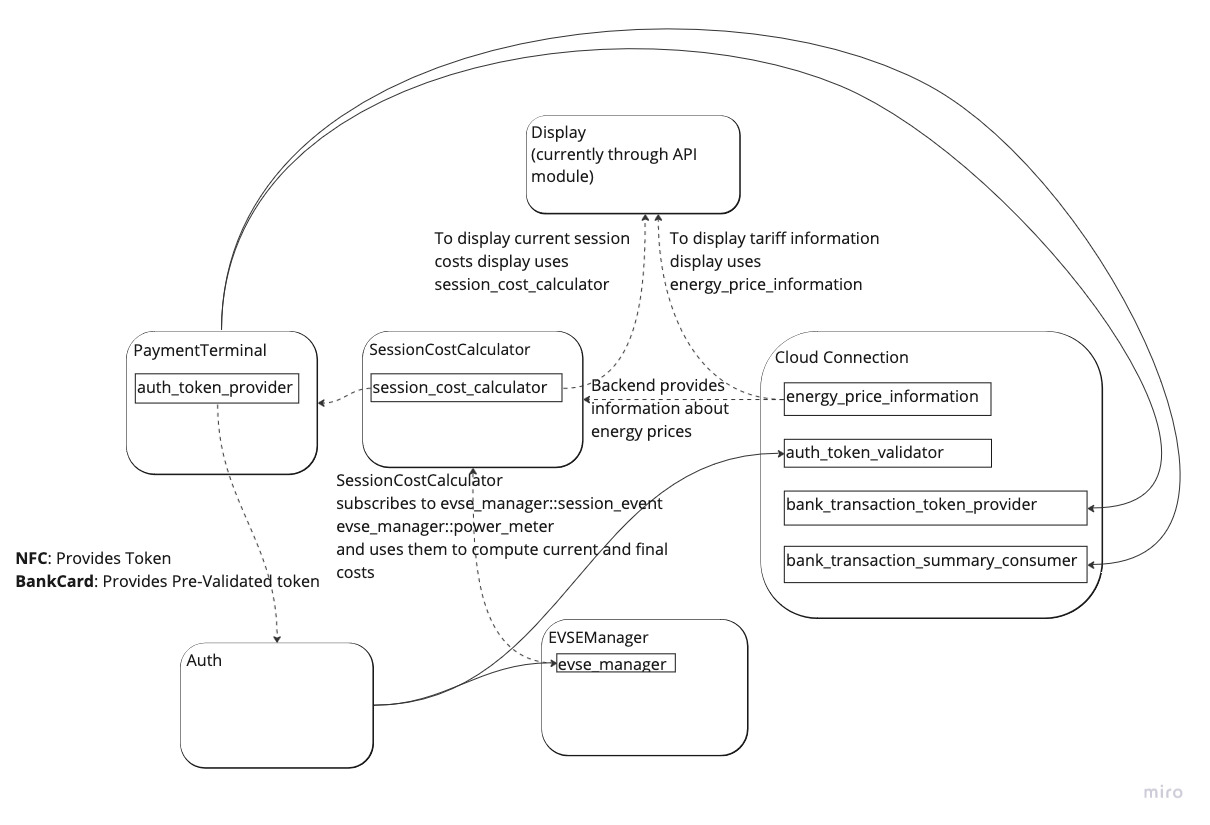

session_cost_calculator: This interface publishes a variable with the session cost for the corresponding EVSE manager. The module that implements the interface is supposed to subscribe to the EVSE manager to get the consumed electricity and time. Depending on the system, the tariff source might be stored locally or loaded from the energy_price_information.yaml, or from another interface. This is not covered in this proposal.bank_session_token_provider: This interface allows to generate or requests from the backend a token to be used in a bank transaction (as sort of “Verwendungszweck”).bank_transaction_summary: This interface is supposed to be implemented by the payment terminal module. It provides accounting information.

6.1.2.2. How does it work¶

Modules are connected as shown in the diagram below.

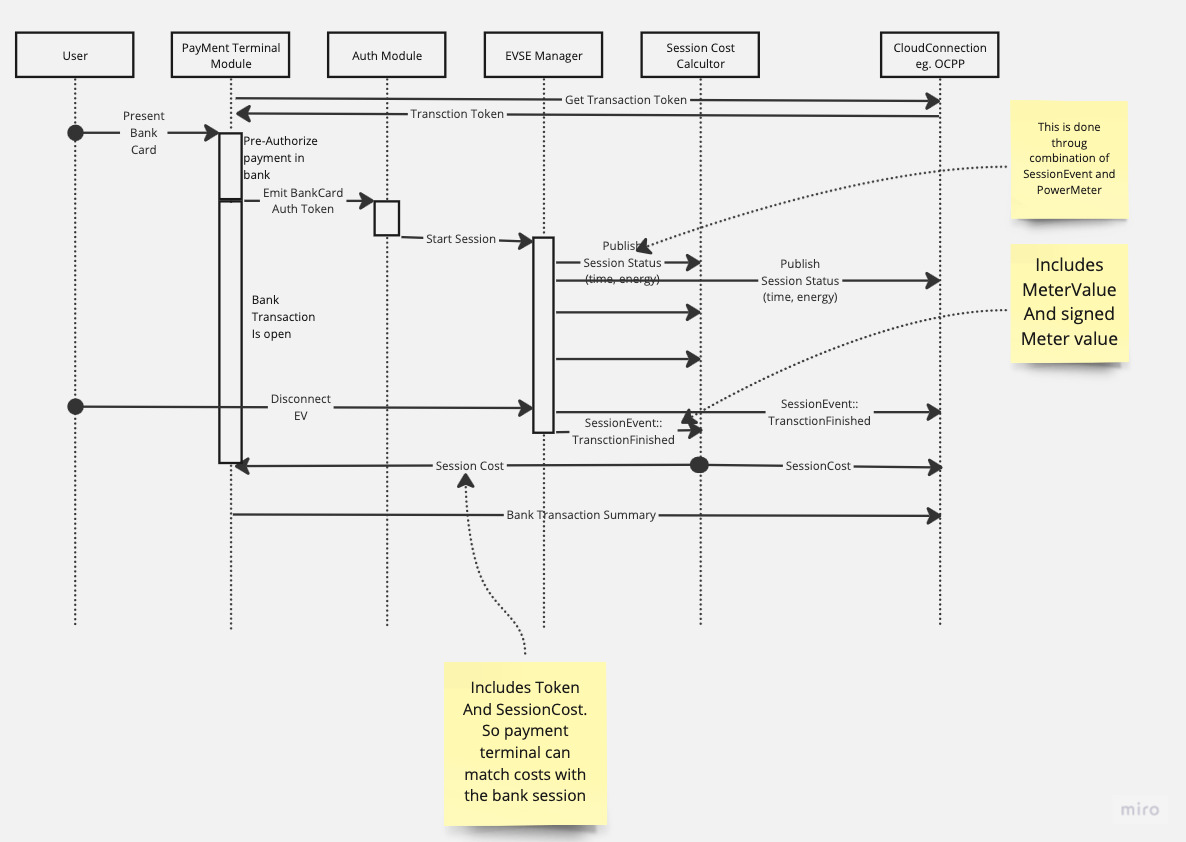

Typical communication will look like:

Payment terminal module implements auth_token_provider interface.

If user pays with a bank card, then payment terminal pre-authorizes

transaction in the bank (potentially reserves money).

And if pre-authorization was successful, payment terminal generates

the AuthToken and publishes it. To distinguish from other tokens, a

new AuthorizationType::BankCard is used.

The token is processed by Auth module as usually. This includes passing to validators. Validators typically always approve the token.

A module that implements session_cost_calculator publishes the session

cost. And the payment terminal subscribes to it. Once the session is

finished (can be detected by status filed in the session cost), payment

terminal commits it.

Payment terminal stores all the issued bank-card tokens to match bank transactions with charging sessions.

Payment terminal can issue a pre-validated token and then start the session without validators involved. This should be sufficient for most cases. But if the system requires to limit usage of certain cards or outlets, validators can be used for that.